Many first-time home buyers in Bergen County, NJ, struggle to break into the housing market as prices continue rising. Since 2019, home prices in Bergen County have surged by 54 percent, with a 10-12% percent increase in the last year. Despite a more stable increase, high interest rates, low inventory, and years of price jumps continue to challenge Americans buying homes.

In Bergen County, home prices have seen significant increases. It now takes a significantly bigger portion of the median income to afford a home than it has on average over the past several decades, according to Andy Walden, vice president of enterprise research strategy at ICE Mortgage Technology. “It’ll take time for the market to come down from the stress it’s faced during the pandemic,” he said. Costs remain elevated due to the low number of homes on the market, partly because homeowners feel “locked in” to their current houses. Previously, a typical homeowner could sell and buy an equivalent house across the street and reduce their mortgage payment. Now, homeowners who give up their current interest rate could pay nearly 40 percent more in monthly principal and interest payments if they move, Walden explained.

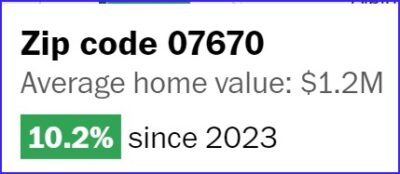

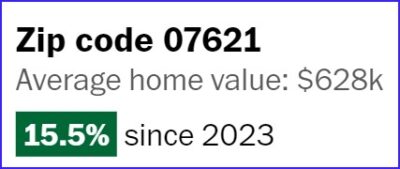

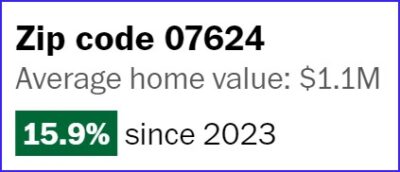

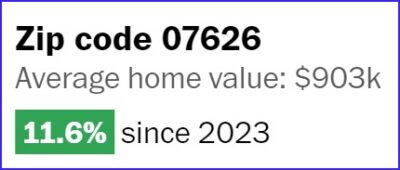

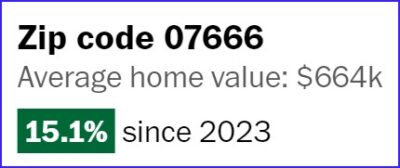

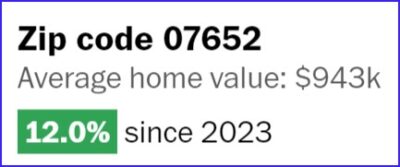

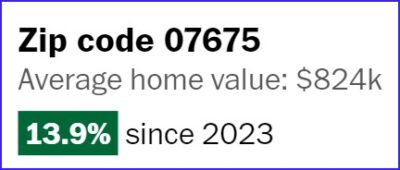

Home prices in Bergen County have grown faster than those in many large cities in the last year. Prices in Bergen County have not seen a decline as some parts of the country have. Tenafly prices increased by 10.2% from 2023, Paramus prices increased by 12%, Teaneck prices increased by 15.1%, Cresskill prices increased by 11.6%, Closter by 15.9%, Bergenfield by 15.5%, and Old Tappan Ridgewood by 13.9% and 13.6%, respectively.

- Tenafly

- Ridgewood

- Bergenfield

- Closter

- Cresskill

- Teaneck

- Paramus

- Old Tappan

Nationally, many large cities, including Manhattan, San Francisco, and New Orleans, have also experienced slight price drops. Conversely, some rural counties in Ohio, West Virginia, and Wisconsin saw the most significant home value increase over the past year. Buying a first home has become increasingly challenging due to price increases and mortgage interest rates of around 7 percent—more than double what they were three years ago.

“It is painful for those first-time buyers that are trying to enter the market,” said Lawrence Yun, chief economist of the National Association of Realtors. In Bergen County, prospective homebuyers face the combined pressures of rising prices and high interest rates, and low inventory making it a tough market to enter.

English

English Chinese

Chinese Korean

Korean Hebrew

Hebrew Russian

Russian