As part of a continuing overhaul of the home mortgage market, initiated by the The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) which followed the 2008 financial crisis, the Consumer Financial Protection Bureau (CFPB) issued a final rule to bolster fairness and clarity in residential lending.

Starting in August 1 2015, new forms will replace the HUD-1 and Good Faith Estimate and change the way your transaction will close.

Since mortgages are complex transactions that may include risky features, congress directed the Consumer Financial Protection Bureau to create new and simplified forms. Because these forms are confusing for many people, the new rule replaces the current forms with two new forms:

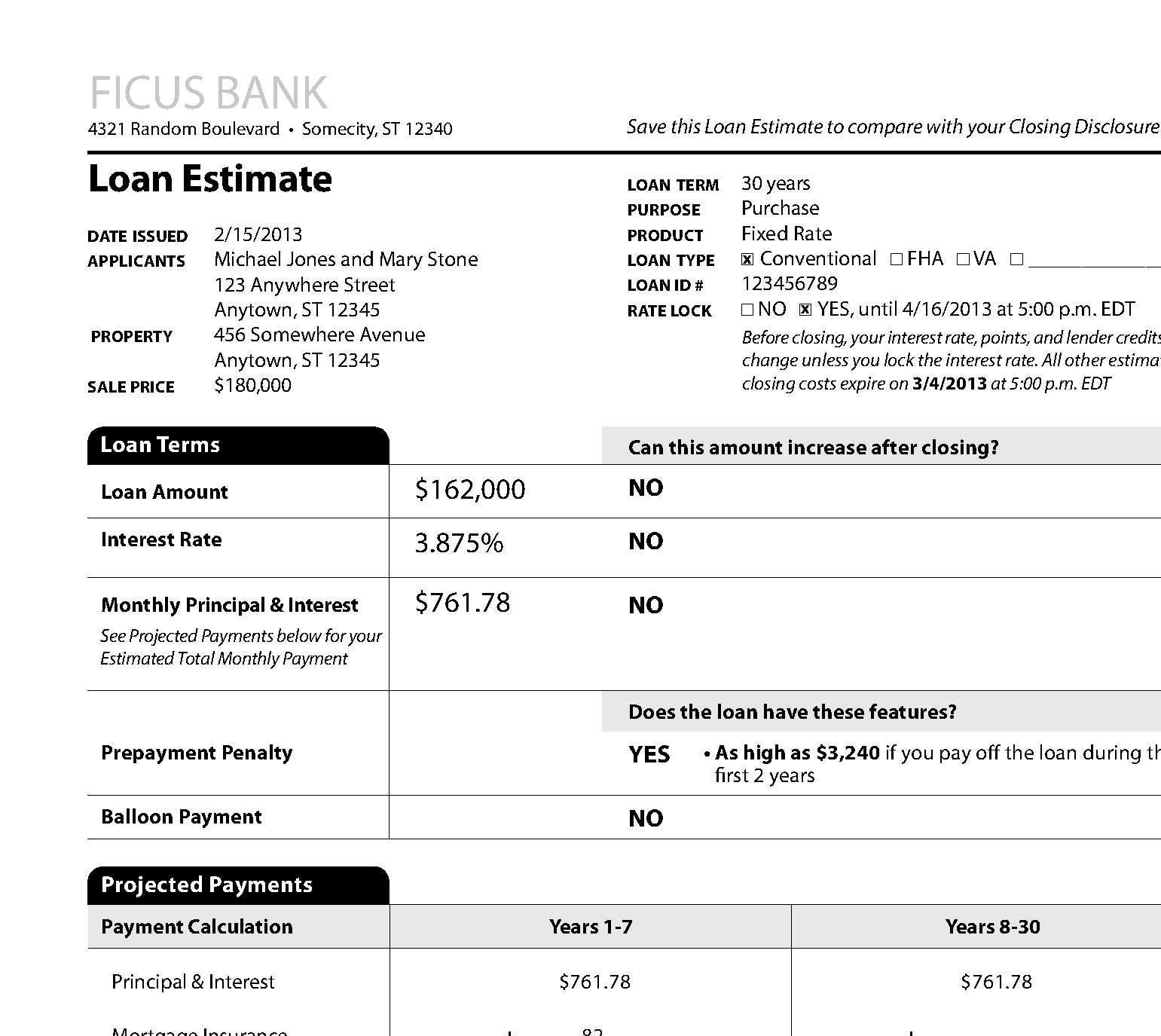

- The New Loan Estimate will replace the current Good Faith Estimate (GFE) and the current Truth in Lending Disclosure (TIL).

- The New Closing Disclosure will replace the current HUD-1 Settlement Statement and is to be given to the buyer three business days before closing.

- Click Here For Comparison of The Old & New Forms

Benefits of the new forms will include:

- Requiring that consumers receive the Closing Disclosure at least three business days before closing on the mortgage loan. Currently, consumers often receive this information at closing or shortly before closing. This additional time will allow consumers to compare the final terms and costs to the terms and costs they received in the estimate.

- Simplified paperwork by using only two forms

- Using clear language and design that will help consumers understand complicated mortgage loan and real estate transactions

- Highlighting the information that has proven to be most important to consumers. On the new forms, the interest rate, monthly payments, and the total closing costs will be clearly presented on the first page.

- Providing more information about the costs of taxes and insurance and how the interest rate and payments may change in the future.

- Making the cost estimates consumers receive for services required to close a mortgage loan more reliable, for example, appraisal or pest inspection fees. The rule prohibits increases in charges from lenders, their affiliates, and for services for which the lender does not permit the consumer to shop unless a specific exception applies

THE CLOSING DISCLOSURE

The final rule and the Official Interpretations (on which creditors and other persons can rely) contain detailed instructions as to how each line on the Closing Disclosure form should be completed. The Closing Disclosure form contains additional new disclosures required by the Dodd-Frank Act and a detailed accounting of the settlement transaction. Timing. The creditor must give the Closing Disclosure form to consumers so that they receive it at least three business days before the consumer closes on the loan. If the creditor makes certain significant changes between the time the Closing Disclosure form is given and the closing – specifically, if the creditor makes changes to the APR above 1/8 of a percent for most loans (and 1/4 of a percent for loans with irregular payments or periods), changes the loan product, or adds a prepayment penalty to the loan – the consumer must be provided a new form and an additional three-business-day waiting period after receipt of the new form. Less significant changes can be disclosed on a revised Closing Disclosure form provided to the consumer at or before closing, without delaying the closing. This requirement will provide the important protection to consumers of an additional three-day waiting period for the three significant changes, but will not cause closing delays for less significant costs that may frequently change

LIMITS ON CLOSING COST INCREASES

Similar to existing law, the final rule restricts the circumstances in which consumers can be required to pay more for settlement services – the various services required to complete a loan, such as appraisals, inspections, etc. – than the amount stated on their Loan Estimate form. Unless an exception applies, charges for the following services cannot increase: (1) the creditor’s or mortgage broker’s charges for its own services; (2) charges for services provided by an affiliate of the creditor or mortgage broker; and (3) charges for services for which the creditor or mortgage broker does not permit the consumer to shop. Charges for other services can increase, but generally not by more than 10%, unless an exception applies. The exceptions include, for example, situations when: (1) the consumer asks for a change; (2) the consumer chooses a service provider that was not identified by the creditor; (3) information provided at application was inaccurate or becomes inaccurate; or (4) the Loan Estimate expires. When an exception applies, the creditor generally must provide an updated Loan Estimate form within three business days

English

English Chinese

Chinese Korean

Korean Hebrew

Hebrew Russian

Russian