Click to Get Our Selling House Guide Winter 2023 Edition

The Real Estate Agent

For most people selling a home is the single largest financial transaction in their lifetime. To do it right, it requires the expertise of a professional of the highest caliber one who is thoroughly familiar with the local marketplace, and has marketing and negotiating skills.

The realtor & the realtor’s team are the crucial links to attracting qualified buyers who can buy your home.

Choosing the right realtor will get you a higher price, & will save you time and aggravations. It is not always the agent who has been in the business the longest who is right for you. It is the realtor with the contacts, marketing savvy, the dedication, energy and, most important the track record of success.

Over the years, Team Eisenberg has sold over 600 properties with a worth of over half a Billion dollars.

Anat & Eran have compiled some amazing sales statistics and an incredible amount of awards and accolades yet when you speak with them you realize that, for them, it is not about the numbers or the awards. They are still passionate about real estate and it shows every day…

Call or email us today to find out more!

The Marketing Plan

Our marketing plan is unsurpassed in its scope and reach. We will give your property the widest possible targeted exposure which will attract the one buyer who will be the right buyer for your home.

The main channels I use to expose your home to the public are:

- The Internet – Real Estate related portals such as Zillow

- Printed Advertising in the neighborhood

- Direct E-Mailing to our wide based client base

- Public Open House

- Social Networking such as Facebook, Instagram, Pinterest, Linkedin

- Internet – targeted advertising – such as Google and Facebook ads

The Internet – Location, Location, Location

Most buyers start their home search online and zero-in on the proeprties they most like. They then only arrange to physically come and look at yoru proeprty.

Your home will showcase on twelve different websites giving it the most comprehensive exposure:

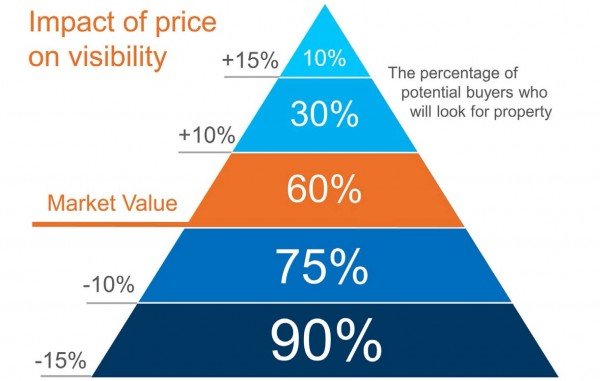

The Listing Price

Price is the single most important influenceable factor in selling your home! The most common and, biggest mistake many sellers make is inflating the listed price of their home! This results in your home being on the market for a long time as buyers pass it over and over.

Buyers shop by price range, and if the listed price of your house is not carefully determined it will be passed over again and again. This may seem counter-intuitive. However, let’s look at this concept for a moment. Many homeowners think that pricing their home a little OVER market value will leave them more room for negotiation. In actuality, this just dramatically lessens the demand for your house

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price it so that demand for the home is maximized. In that way, the seller will not be fighting with a buyer over the price but instead will have multiple buyers fighting with each other over the house.

Realtor.com, recently gave this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly under-priced, especially in areas with low inventory.”

I will provide you with Comparative Market Analysis that I will prepare for you free of charge. I will show you what similar properties sold for, which other competing properties are on the market at the time you will want to sell yours and ,what advantaes your property has over other competing properties.

Condition Of Your Home

Nobody likes to put money into a home that is to be sold soon. However, it usually pays to make aesthetic improvements that do not cost much but make a big difference in the appearance of your home. These improvements will usually enhance your home’s value which will be reflected in the price a buyer will be willing to pay. I will guide you as to what improvements will be the most cost-effective in the sale.

The Closing – Settlement

Printable Seller’s Closing Costs

This is the date when all parties get together, usually at the buyer’s attorney’s office, for settling of all accounts and signing of documents.

Participants in this meeting are usually; Seller, Buyer, Real Estate Agents, Attorneys and at times a Mortgage company representative.

During this meeting mortgage is being signed, checks are exchanged, adjustments are made for such items as property taxes, seller is paid and, you the buyer get the title and the keys to your new home!

All the payments to the various parties are recorded by the attorney on a standard form called Closing Disclosure which itemizes the debits and credits of the seller and buyer. Effective August 1st 2015 this form will have to be provided to the buyer at least three business days before closing.

If the creditor makes certain significant changes between the time the Closing Disclosure form is given and the closing – specifically, if the creditor makes changes to the APR above 1/8 of a percent for most loans (and 1/4 of a percent for loans with irregular payments or periods), changes the loan product, or adds a prepayment penalty to the loan – the consumer must be provided a new form and an additional three-business-day waiting period after receipt of the new form. Less significant changes can be disclosed on a revised Closing Disclosure form provided to the consumer at or before closing, without delaying the closing.

New Jersey Realty Transfer Tax Fees

Effective August 1st 2004 there are increases in the NJ Realty Transfer Tax Fees paid by the seller. Increases apply to residential Real Estate & New Construction which exceed $350,000!

Listed bellow is a quick reference showing the new Transfer Fee for every $100,000 of the sale price:

For $500,000 the tax is; $4175

For $600,000 the tax is; $5185

For $700,000 the tax is; $6245

For $800,000 the tax is; $7305

For $900,000 the tax is; $8415

For $1,500,000 the tax is; $15,625

For $2,000,000 the tax is; $21,675

For $2,500,000 the tax is; $27,725

For $3,000,000 the tax is; $33,775

For $3,500,000 the tax is; $39,825

There is a different schedule for Senior Citizens, Disabled & Low & Moderate Income. The Transfer Fee is calculated per $1000 in varying increments. For specific calculations please call or e-mail me.

English

English Chinese

Chinese Korean

Korean Hebrew

Hebrew Russian

Russian