The 10-year bond dropped below 2% this week as a result of poor economic data from Europe, China and the US. Additionally, and almost hard to believe, the world financial markets are rattled by the potential economic implications of a spreading Ebola virus. Crazy that Ebola is actually affecting bond and mortgage rates! Let me share with you the way I see it: While the economic data clearly doesn’t present a rosy picture, most of that economic risk (and downward interest rate pressure) is now built into bond and mortgage rates. This means that we are unlikely to see rates drop further in the near term based purely on economic data.

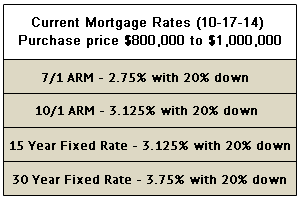

What’s my message? Take advantage of recently released economic data and ‘‘the world is ending” hysteria and lock in your mortgage rate now. While rates have been low for quite some time, this recent cratering of mortgage rates is providing you with what may be one last opportunity to refinance your mortgage. My message is the same to those looking to buy a home: find a home and lock in what may be the lowest rates you’ll ever see. NOW is the time

Direct 973-830-8789

Cell 848-203-2272

Fax 973-215-2642

[email protected]

English

English Chinese

Chinese Korean

Korean Hebrew

Hebrew Russian

Russian