Despite rising home values, homeownership remains very accessible for buyers that can scrape together a down payment – even if that down payment is relatively modest – find a home to buy and secure financing,” said Zillow Chief Economist Stan Humphries.

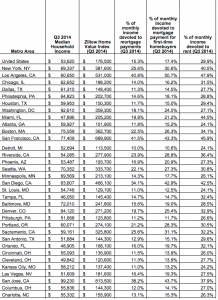

On average, homebuyers making the nation’s median income and purchasing the typical U.S. home spend 15.3% of their income on their monthly house payment, down from the historical norm of 22.1% during the pre-bubble period from 1985 to 1999

In contrast, renters spent 29.9% of their monthly income on rent in the third quarter of 2014, up from 24.9% historically.

Homes for younger buyers remain affordable thanks to continued low mortgage interest rates and their tendency to shop for less expensive homes.

Homeownership rates in the U.S. have steadily declined, even as the housing market has recovered, in part because millennials have delayed their entry into the housing market.

English

English Chinese

Chinese Korean

Korean Hebrew

Hebrew Russian

Russian